Fund Manager

STAG FUND MANAGEMENT SCR S.A.

STAG FUND MANAGEMENT SCR S.A.

BISON BANK, S.A.

BDO & Associados, SROC, Lda

CMVM

CMS Portugal

8 years (including subscription period)

At least 60% permanently invested in companies incorporated under Portuguese law and based in Portugal.

Level 6 according to ESMA Framework

€ 25.102.000,00

€ 250.000,00

€ 3.000,00 + VAT

2% p.a.

Golden Visa processing fees (management, representation, taxes, GV fees) are calculated separately.

The income generated by the Fund shall be capitalized during the Fund’s lifetime and distributed to the Unit Holders upon the respective liquidation of the Fund.

90 % to Classe A Holders 10% to Classe B Holders

(Distributions to Unit Holders)

0% tax in Portugal

Subject to a 28% witholding tax on fund profits.

The fund is exempt from corporate income tax (IRC) due to the principle of tax neutrality.

Dividends received from the portfolio companies are not taxed.

Subject to the normal Corporate tax regime (IRC), with a general rate of 20%. Companies based in Madeira Islands can benefit from a 30% Corporate tax redution.

*except for residents in territories subject to more favourable fiscal regimes or entities owned by Portuguese residents.

Note: Based on the legislation in force at the date of publication of this website, therefore subject to any supervening legal changes.

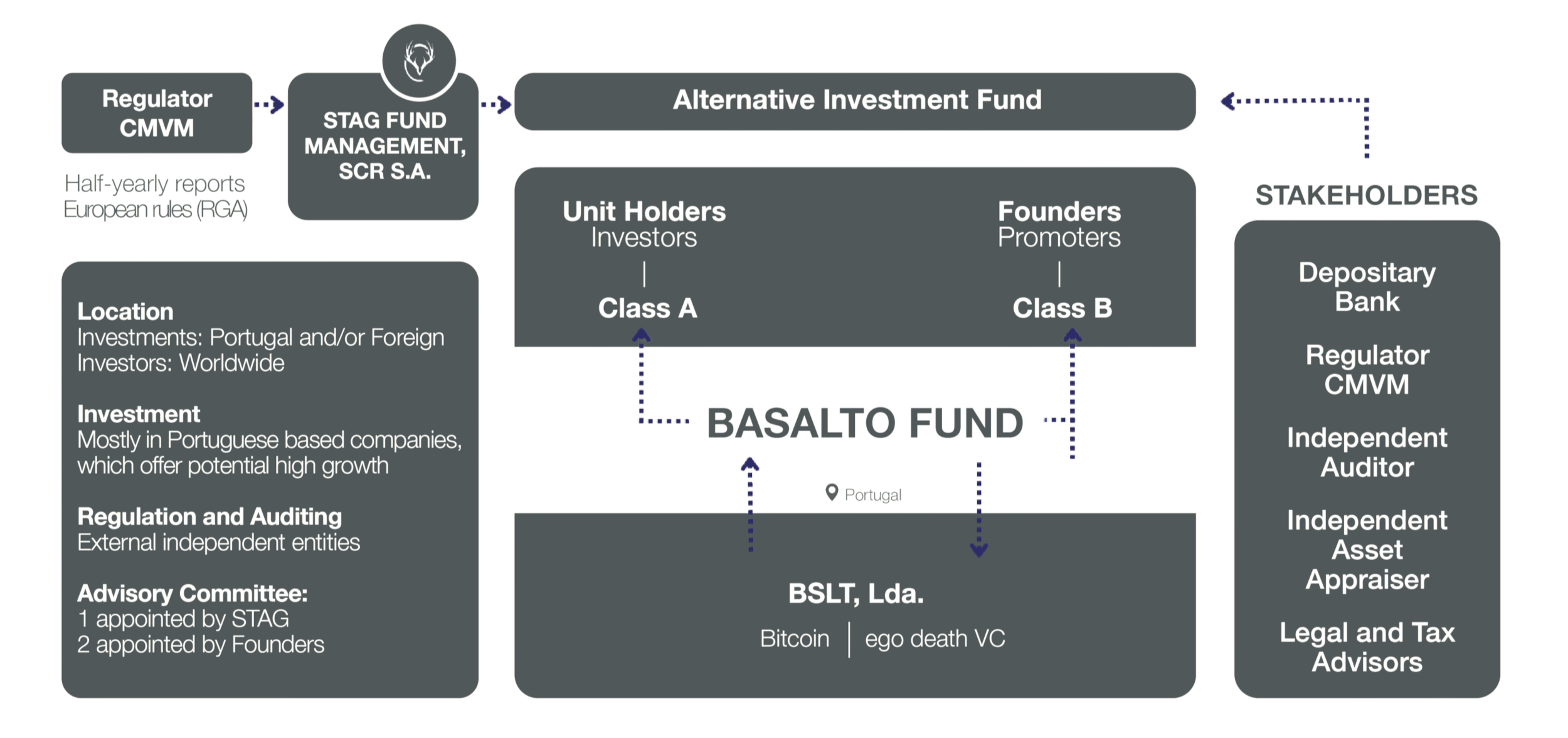

BASALTO (referred to as the "Fund") is an alternative investment fund registered in Portugal and managed by STAG (the "Fund Manager"). The Fund is exclusively administered by the Fund Manager. The Fund is exclusively promoted by the Fund Manager directly or through one sole tied agent supervised by the Fund. The content of this document is solely the responsibility of the Fund Manager.

This document does not constitute a due diligence review, nor does it serve as an offer or solicitation to buy or sell Fund ́s units. Prospective investors should be aware that acceptance into the Fund is subject to a thorough KYC (know Your Costumer)process conducted by the Fund Manager, which may result in rejection if eligibility criteria are not met or if required documentation is not provided.

The information provided in this document is for informational purposes only and shall not be understood in any circumstance as financial or investment advice. The Fund Manager does not guarantee the accuracy or completeness of the information. Investing in alternative investment funds carries inherent risks, including the possibility of total capital loss. It is important to carefully evaluate these risks and to ensure that investment decisions align with individual financial goals and risk tolerance.

Therefore, investors strongly encouraged to perform their own due diligence, seek independent professional advice, and assess the legal, regulatory, tax, and investment implications and risks associated before making any investment decision.

The value of investments, along with any returns generated, may change in whole or in part due to external market conditions. Although the Fund Manager remains committed to its investment strategy, investors should shall additionally recognize that participation in the Fund carries the risk of total capital loss.

The Fund adheres to all applicable legal and regulatory requirements to ensure compliance and protect investor interests. This includes maintaining proper documentation, following reporting standards, and implementing best practices in governance and accountability.

The Fund Manager therefore accepts no responsibility for any possible damage or loss resulting directly or indirectly from the use of the information presented, regardless of the form or nature it may take.

This document contains confidential information and is intended solely for the recipient's use. It may not be copied, distributed, shared, or published, in whole or in part, without prior written consent from the Fund Manager.